Managing rental property is challenging. To run a successful rental community, for example, you’ll need to care for the land, buildings and other assets like HVAC systems and utility lines. You’ll need to meet or exceed resident expectations and support your staff. Then, there are legal, market and financial concerns that come with buying, selling and holding real estate.

The more diverse your properties and communities are, the more complex managing them becomes. At some point, every property owner should consider two types of management practices: property management and asset management.

Property management and asset management are sometimes used interchangeably, but they’re two distinct practices that help community owners achieve different goals. Here’s how to know the difference, when to choose one over the other, and how asset and property management can work together to maximize success.

What is property management?

Property management is the daily oversight of residential or commercial real estate. Owners may participate in property management directly, but more often, they hire a property manager or outsource it to a company that specializes in property management.

Property management includes:

Resident management: Finding, screening and moving residents in, then providing a good resident experience. Large communities often employ leasing and resident experience teams dedicated to these tasks.

Maintenance and repairs: Keeping your community looking good and functioning well, including buildings, equipment and landscaping. Large communities employ a maintenance team, while small communities may outsource maintenance.

Rent collection: Managing payments, delivering past-due notices, and, if necessary, handling evictions.

Financial management: Planning efficient staffing and other resources to maximize a community’s profitability.

Legal compliance: Ensuring your community follows all laws and regulations while avoiding legal liabilities.

Property managers and the resident experience

A property manager is an intermediary between a community’s owner and its residents. An owner may never meet its residents in person, while a property manager spends their day in the community seeing to residents' needs.

A property manager might:

Conduct regular property inspections.

Address tenant complaints and requests.

Handle evictions if necessary.

Market and advertise vacant properties.

Property managers and profitability

Successful property managers closely follow market trends, stay up-to-date on property values, and understand tenant behaviors. That’s because they’re charged with maximizing the profitability of a multifamily community.

Property managers maximize ROI by:

Protecting an owner’s investment

Ensuring high occupancy

Minimizing vacancies

Maintaining the property’s condition

Mitigating risk and ensuring legal compliance

A property manager’s day-to-day

Property managers serve as the owner’s representatives and spend most of their time on-site at the properties they manage. An owner may assign a single property manager to oversee a single community. Or, if property management is centralized, the owner may have a team of a few managers who work together to collectively manage a handful of nearby communities.

A typical day for a property manager might include:

Distributing and reviewing rental agreements before leasing to prospects

Coordinating with maintenance technicians to minimize any disturbances during regular maintenance, repairs or renovations

Reviewing rent payments software to ensure all residents have paid on time, and flagging any late or missing payments

Working with a resident experience manager to plan and execute a community barbecue

What is asset management?

Asset management is a strategic approach to managing a portfolio of real estate properties to maximize their value and financial performance over time. It focuses on the broader financial and investment strategy for properties, rather than day-to-day operations.

While property management deals with the operational aspects of managing a property, like maintenance, tenant relations and rent collection, asset management focuses on the strategic, long-term financial performance of the property or portfolio.

Asset management includes:

Portfolio management: Forming and implementing strategies for buying, selling and refinancing properties.

Financial analysis and planning: Analyzing portfolio performance to find ways to increase income or cut costs.

Market research and analysis: Staying up-to-date on market trends and planning for changes in supply, demand and interest rates.

Risk management: Diversifying assets and mitigating risks from changing regulations and markets.

What assets do asset managers look after?

The assets in a rental portfolio include the properties themselves and any buildings on them. But assets also include:

Equipment such as maintenance tools, landscape equipment and HVAC systems.

Vehicles such as golf carts and company cars.

Electronics such as computers, leak detectors, thermostats and company cell phones.

Utility infrastructure such as fiber optic internet lines, built-in networking equipment, and access gates.

Financial assets like cash on hand, stocks, CDs and other investments.

While property managers might look after many of these individual assets on-premises, asset managers take a higher-level view, considering the performance of groups of assets as a whole. For instance, asset managers might explore portfolio-wide initiatives, such as upgrading a fleet of vehicles to electric vehicles or transitioning from restrictive internet contracts to managed WiFi solutions.

An asset manager’s day-to-day

While property managers focus on optimizing ROI in the present, asset managers zoom out to look at long-term profitability and property values.

An asset manager’s day might look like:

Mining the latest market reports for insights

Deciding whether to buy new properties or sell existing ones

Researching new technologies, processes and systems to enhance property value or optimize ROI across the protfolio

Reviewing portfolio data to look for trends in vacancies, rental income and operating expenses.

While property managers are often boots-on-the-ground in your communities or part of a small management pod, asset managers often work out of a centralized office. They may not need to step foot in an individual community, and instead focus on the larger picture of the owner’s holdings.

Benefits of asset management

Investors hire an asset manager when they have multiple properties and want to maximize ROI across their entire portfolio instead of on a community-by-community basis. Owners with one or a handful of communities may not need an asset manager. But the larger your portfolio, the greater the need to maximize profitability in broad strokes.

Effective asset management can significantly enhance the profitability of real estate investments by improving financial performance, increasing property value and enhancing ROI.

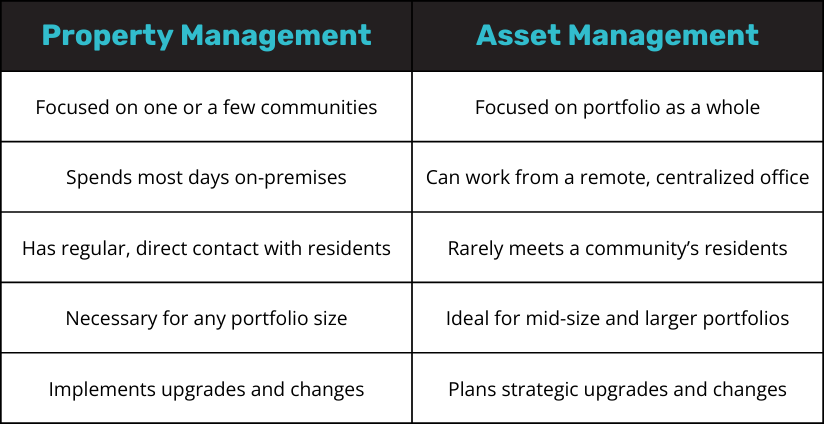

Key differences between property management and asset management

Confusion around the differences between property and asset management may come from the fact that property is an asset. But these two forms of real estate management are very different. Both roles are essential to the successful management of real estate, but they serve different purposes and require distinct skill sets. Understanding that difference is critical for hiring the right personnel and getting the most out of your investment.

Property management is the day-to-day oversight of real estate properties, including tasks such as rent collection, tenant relations, property maintenance and lease management. Asset management is the strategic management of a real estate portfolio aimed at maximizing its financial performance and value over the long term.

While property managers participate in some strategic planning for their own communities, it’s helpful to think of asset managers as strategists and property managers as implementers. For example, if an asset manager chooses to upgrade to SmartRent across a portfolio, the property manager will coordinate installation, training, and resident communications in their communities.

The relationship between asset and property managers is symbiotic. Asset managers rely on property managers to provide accurate, up-to-date information on property operations, tenant relations and maintenance needs. Property managers depend on asset managers to guide financial goals, investment strategies and capital improvements. Effective collaboration between the two roles helps owners and investors maximize performance at both the community and portfolio levels.

When to choose property management over asset management

Because property owners focus on day-to-day operations, most owners will hire a property manager at some point. Those who own multiple properties may be unable to manage them alone. However, even single-family homeowners will sometimes hire a property manager or company simply because they don’t want to or don’t have the time to manage their own property.

Hiring a property manager depends on an owner’s goals and the community's needs. If you own property located far from you, you’ll need a boots-on-the-ground manager to handle its operations. You may also wish to hire a property manager for a large community, or if you want to focus on other aspects of your business.

Single-property ownership

If you have just one property, even a large one, hiring a property manager is usually sufficient to maximize your investment. You may be able to handle any additional management tasks yourself.

Focus on day-to-day operations

Property managers can help with daily tasks like dealing with tenants, coordinating repairs and handling routine maintenance. If daily operations in your community could use some efficiency or performance improvements, hiring a property manager is a good move.

Limited interest in strategic investment decisions

Some property owners are not very interested in or knowledgeable about making strategic financial decisions for their properties. For these owners, improving how the properties are managed daily is the best thing to focus on.

Budget constraints

Property management is generally more cost-effective than asset management, making it a more accessible choice for owners with limited budgets or those looking to minimize expenses. Once you begin seeing efficiencies at the property level, you can use your savings to finance asset management.

Local and small-scale investors

Local investors or those who manage properties in a specific geographic area often benefit more from property management due to its focus on localized operational efficiency and compliance with local laws and regulations

When property management isn’t the answer

Although a property manager can help maximize the ROI of a specific property or group of properties, property management does not typically include the strategic financial planning and investment strategies. For these, you should hire an asset manager.

When to choose asset management over property management

Whether you should hire an asset manager depends on your investment goals, property types and preferences. If your primary goals are strategic oversight, financial optimization and portfolio growth, you probably need an asset manager. Because asset management goes beyond the day-to-day operations of individual properties to encompass broader investment strategies, financial analysis and long-term planning, it goes beyond managing at the individual community level.

Large or diverse portfolios

Asset managers zoom out to look at a portfolio as a whole. You’ll have the greatest need—and see the most value—from asset management if you have a large or diverse real estate portfolio.

Focus on maximizing ROI and value

While property managers often concern themselves with the resident experience of their communities, asset management deals mainly with financial returns. So, if your primary goal is maximizing ROI and value, asset management is essential.

Involvement in strategic decisions

Asset managers are an invaluable resource for strategic decision-making. Owners who plan to acquire more properties, sell from their existing portfolio or reposition themselves in the market should consider asset management.

High-value or complex properties

Many single-property owners forgo asset management, but large and complex properties may require it. If you have a commercial building, mixed-use development or luxury property, asset management is crucial.

Long-term investment horizons

Asset managers focus on long-term investment strategies that prioritize capital appreciation, portfolio diversification and strategic growth rather than immediate cash flow or operational concerns. If you’re thinking long-term, an asset manager is crucial. But if you’re focused on short-term strategies like flipping, wholesaling, or land development, asset management might not be necessary.

When asset management isn’t the answer

Asset management is best suited for large or complex portfolios, so if you have just one or a few rental communities, you might not need an asset manager. Meanwhile, if you’re still dialing in management at the community level, we suggest starting with property management because you’ll see improvements to your ROI.

The role of technology in property and asset management

Although real estate has been slower to adopt new technologies than many other industries, the rental industry increasingly relies on technology, especially in property and asset management. Many owners are moving from slower, hands-on systems to digitized systems. As they do, technology won’t be just a trend but a necessity for staying competitive, improving efficiencies and meeting the evolving demands of tenants, investors and stakeholders.

How property management uses technology:

Automation of routine tasks: Technology automates routine tasks like rent collection, maintenance scheduling and tenant communications.

Property management software (PMS): PMS platforms such as Yardi, RealPage and Entrata help manage leases, track maintenance requests and provide financial reporting.

Tenant experience enhancements: Online portals, mobile apps for communication and payments, and automated responses for maintenance requests help provide white-glove service without overwhelming staff.

Data-driven decision-making: Digital systems give property managers the opportunity to collect and analyze more data. This information allows them to make better decisions about tenant behavior, occupancy rates and market trends.

How asset management uses technology:

Advanced analytics and forecasting tools: Assess market trends, predict property values and make strategic investment decisions.

Portfolio management software: Streamline asset management tasks like financial modeling, risk assessment and performance tracking across multiple assets.

Real-time data access: After a digital transformation, accessing real-time data helps asset managers make more timely and informed decisions regarding acquisitions, dispositions and portfolio rebalancing.

AI and machine learning: AI that uses machine learning can see patterns and make predictions that help asset managers optimize investment strategies, predict market changes, and manage risks.

While technology is critical for both property and asset management, adopting new systems comes with its own challenges and limitations. Before you choose a platform, consider:

High initial costs and training: Although implementing new property technology requires an upfront investment for installation, training and initial support, this investment positions owners and managers to achieve greater operational efficiencies and cost savings over time through increased productivity, reduced errors and enhanced resident satisfaction.

Cybersecurity risks: While incorporating new property technologies means collecting and utilizing more data, this also requires pairing those solutions with heightened cybersecurity measures to safeguard sensitive resident, financial and operational information from potential hackers.

Data privacy concerns: Incorporating new property technologies involves collecting and using data that pertains to residents and staff, which requires prioritizing data privacy through transparent practices to address any potential concerns.

Overdependence on technology: The more you rely on technology for property and asset management, the greater the impact on your business if something goes wrong. Have a manual backup plan for handling operations to help minimize disruptions.

The right management approach for you

Property management and asset management are two distinct fields, but they work together to ensure success for owners and investors.

Property management focuses on the day-to-day operations at the individual community level, and property managers act as an intermediary between owners and residents. That makes them great sources of data and insights into your communities. Asset management zooms out to maximize ROI on a portfolio level, often using data provided by property management while defining the strategies that property managers will roll out.

Whether you need asset management, property management, or both depends on your community and goals. But the right technology partner can power your team’s success, whichever you choose. Learn more about our property and asset management solutions. Or contact us to find the right management approach for your investments.